Benefits in kind for company cars

Your business can claim benefits in kind (ATN) for your company cars categorised as M1 (passenger transport ≤ 8 seats + driver). These company cars, owned or rented/leased by the employer and provided at least in part for purposes outside of the employee's professional activities, are covered by the state's ATN system (benefits in kind). Eligibility for the flat-rate benefit in kind is not subject to any residence restrictions.

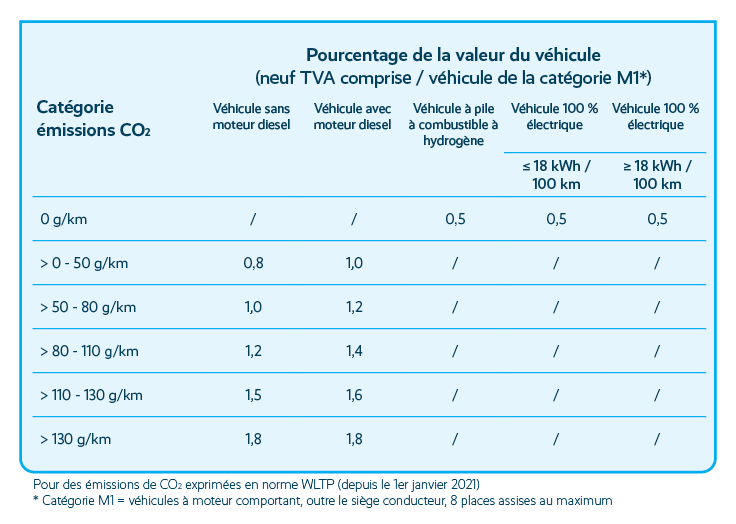

How to calculate the rate of the benefit in kind

The in-kind benefit rate is based on the type of engine and the CO2 emissions. Since 2022, the flat rate for the benefit in kind is 0.5% for a 100% electric car. For a plug-in hybrid car, the applied rate depends on the CO2 emissions as well as the type of engine (hybrid/petrol or hybrid/diesel). For older contracts, the rate of the former regulation will continue to apply.

How to calculate the lump-sum benefit?

To determine the taxable lump-sum benefit, multiply the car's purchase price by the lump sum. In short: the lower the percentage of the benefit, the less tax you will have to pay for the company car.

Since 2020, the ATN (Benefit in Kind) is calculated using the WLTP (World Harmonised Light Vehicle Test Procedure) standards. More information on the new WLTP test cycle is available at www.wltp.lu.

Amendment of the benefit in kind rate for company cars starting in 2025

For newly registered company vehicles from 1 January 2025 onwards, and for which no contract has been signed prior to 31 December 2024, the flat rate of the ATN (Advantage in Kind) will be simplified.

A 1% rate will be set for pure electric cars with an electric energy consumption of up to 18 kWh/100km and for hydrogen fuel cell vehicles. For electric company car models with an electric energy consumption of more than 18 kWh/100km, a rate of 1.2% will be mandated.

For other engines, including petrol, diesel, CNG, LPG and all hybrid and plug-in hybrid engines with a combustion engine, the rate for calculating the monthly value of the ATN (benefit in kind) will be set at 2%. This is to encourage the employee to opt for a company car with zero CO2 emissions.

For more information on the regulation of benefits in kind: https://legilux.public.lu/eli/etat/leg/rgd/2022/05/12/a256/jo