1. Context

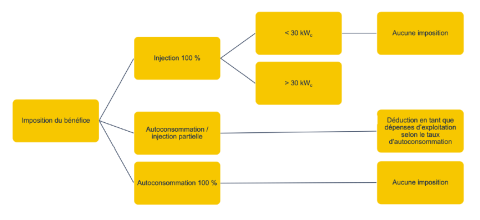

The tax treatment of the operation of a photovoltaic system differs according to the individual's choice, and one must distinguish between 3 cases:

- the operator sells the total production to the grid operator

- the operator consumes the generated electricity himself

- the operator consumes the amount of electricity needed for private or professional use, and only sells any surplus

In case 1, the operator of a photovoltaic system with an operated capacity above 30 kWp, sells the total electricity output produced to the grid operator. This is considered a business activity and the remuneration received from the sale of electricity constitutes taxable income.

In the case of a natural person who operates a small photovoltaic system (power: 1 kWp to 30 kWp) the Administration des Contributions Directes accepts, for the sake of simplification and as a matter of administrative tolerance, that the production of electricity is, generally speaking, a hobby that is not taken into account when determining taxable income.

In the case of self-consumption (case 2), the operation of the photovoltaic system is not considered a commercial activity and does not fall within one of the other categories of income listed in article 10 of the amended law on income tax (L.I.R.). There is therefore no taxable benefit but, depending on the use of the produced electricity, the expenses related to the photovoltaic system can be fully deductible as operating expenses. These different cases are described in Circular L.I.R. no. 14/2[1] and deal with the coverage of energy needs:

- of the taxpayer's household,

- of a commercial enterprise,

- a farm or forestry operation,

- the exercise of a liberal profession,

- of a combination of the above,

- of a tenant in the context of a building lease.

[1] Circular of the Directorate of Taxes L.I.R. no. 14/2 of 5 June 2023 replacing Circular L.I.R. no. 14/2 of 22 September 2021 with effect from the tax year 2023.

2. Définitions et terminologie

Prix d’acquisition

Le prix de l’acquisition de l’installation photovoltaïque est à considérer isolément, même dans le cas où l’installation photovoltaïque est intégrée dans le toit de l’immeuble. Sont éligibles : tous les éléments nécessaires pour l’installation photovoltaïque, dont notamment la (les) facture(s) de l’installation émise par le fournisseur de l’installation, la facture concernant la mise en place du compteur émise par le gestionnaire du réseau, etc.

Les aides étatiques

Le prix d’acquisition est à réduire du montant de la subvention étatique accordée par le Ministère de l’Environnement, du Climat et de la Biodiversité. On distingue entre 2 options de subvention :

Option 1 : 20% des coûts effectifs hors TVA, limitée à 500 € / kWc

Condition : Avec injection dans le réseau (à 100% ou moins) et un tarif d’injection défini pour 15 ans

Option 2 : 50% des coûts effectifs hors TVA, limitée à 1.250 € / kWc2

Condition : Autoconsommation et renonciation à un tarif d’injection défini

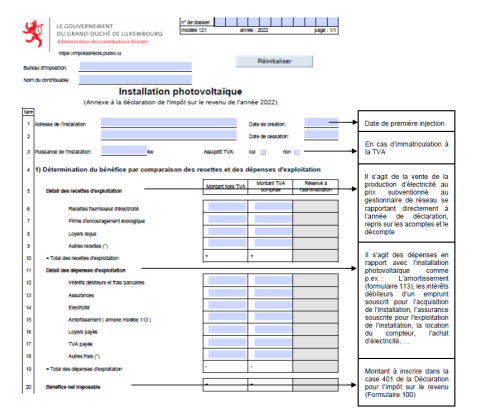

Bénéfice commercial

Le bénéfice commercial se compose des recettes et des dépenses d’exploitation de l’installation photovoltaïque. Les recettes comprennent la vente de la production d’électricité (au prix subventionné) au gestionnaire de réseau électrique, se rapportant directement à l’année de déclaration, repris sur les acomptes et le décompte (si applicable). En cas de première déclaration, il se peut que seuls les acomptes soient disponibles.

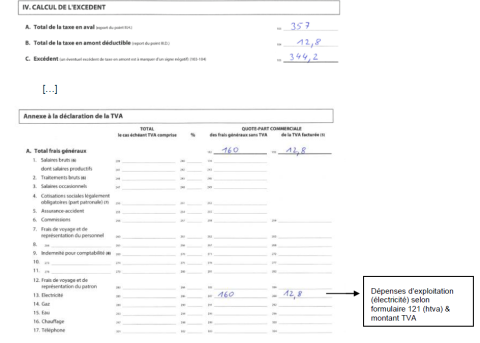

Dépenses d’exploitation

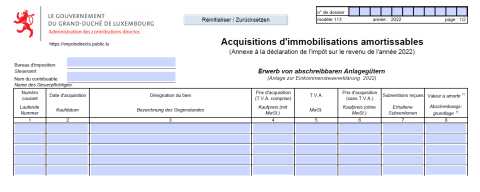

Les dépenses en rapport avec l’installation photovoltaïque comme par exemple les frais de compteurs ainsi que les intérêts en relation avec le financement de l’installation sont intégralement déductibles en tant que dépenses d’exploitation. Dans le cas où le financement de l’installation serait couvert par un crédit immobilier global pour une construction, les intérêts sont déductibles au prorata du montant de l’installation par rapport au montant global. Le montant de l’amortissement constitue également une dépense d’exploitation déductible du bénéfice commercial réalisé (voir formulaire 121).

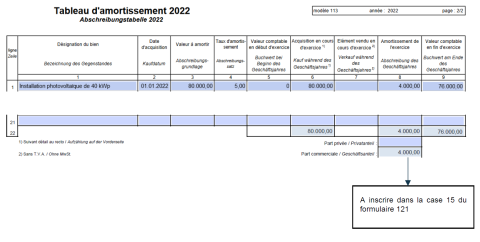

Amortissement

Selon la Circulaire L.I.R. n°14/2 du 5 juin 2023 (Direction des Contributions Directes), la durée usuelle d’utilisation d’une installation photovoltaïque est de 20 ans au moins et le taux d’amortissement éventuel est fixé à 5% par an.

[2]Augmentation temporaire de la prime de 50% à 62,5%, limitée à 1.562,5 €/kWc en respectant différentes conditions techniques pour toute commande avant le 30 juin 2024.2. Definitions and terminology

Purchase price

The purchase price of the photovoltaic system is considered separately, even if the photovoltaic system is integrated into the roof of the building. The following are eligible:all necessary elements for the photovoltaic system, including the supplier's invoice(s) for the installation, the grid operator's invoice for the installation of the meter etc.

State subsidies

The purchase price is reduced by the amount of the state subsidy granted by the Ministry of the Environment, Climate and Biodiversity. We distinguish between 2 subsidy options:

Option 1: 20 % of the effective costs excluding VAT, limited to 500 € / kWp

Condition: with supply to the grid (100 % or less) and a guaranteed feed-in tariff for 15 years

Option 2: 50 % of the effective costs excluding VAT, limited to 1,250 € / kWp

Condition: Self-consumption and waiver of a guaranteed feed-in tariff

Business profit

The commercial profit is calculated from the revenue and operating expenses of the photovoltaic system. Revenue includes the sale of electricity production (at the subsidised price) to the electricity grid operator, directly related to the reporting year, included in the advance payments and the statement (if applicable). In the case of first-time declarations, only advance payments may be available.

Operating expenses

Expenses related to the photovoltaic system, such as meter costs and interest related to the financing of the system, are fully deductible as operating expenses. If the financing of the installation is covered by a global construction mortgage, the interests are deductible in proportion to the amount of the installation compared to the global amount. The amount of depreciation is also an operating expense deductible from the realised business profit (see Form 121).

Depreciation

According to Circular L.I.R. no. 14/2 of 15 June 2023 (Direction des Contributions Directes), the usual duration of use of a photovoltaic system is at least 20 years and the possible depreciation rate is fixed at 5% per year.

3. Forms

The tax return for a natural person operating a photovoltaic system consists of several forms, described below. The first declaration should be made for the year in which the investment was made, even if the taxpayer has not yet received any revenue. All supporting documents must be attached to the various forms (copies of invoices, copies of advances, etc.).

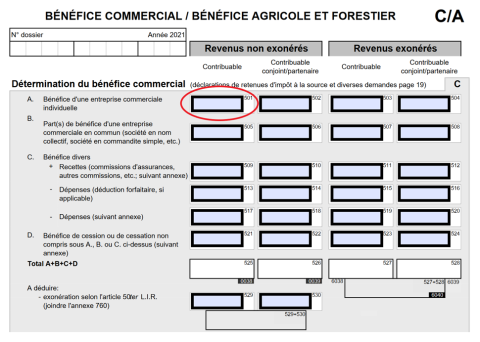

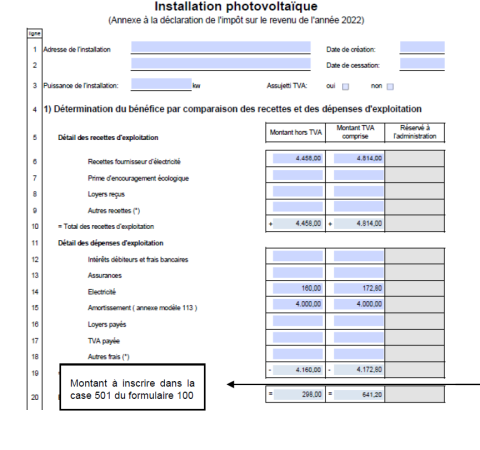

3.1. Income Tax Return (Form 100)

The realized business profit is entered in box 501 of the Income Tax Return (Déclaration pour l’impôt sur le revenu Form 100) under the heading "business profit" (page 5).

Sont à rajouter les annexes suivantes :

- Installation photovoltaïque (Formulaire 121)

- Acquisition d’immobilisations amortissables (Formulaire 113)

The following annexes must be added:

- Photovoltaic system (Form 121)

- Acquisitions of depreciable capital assets (Form 113)

3.2. Photovoltaic system (Form 121)

This annex is used to determine the commercial benefit to entered in box 501 of the income tax return.

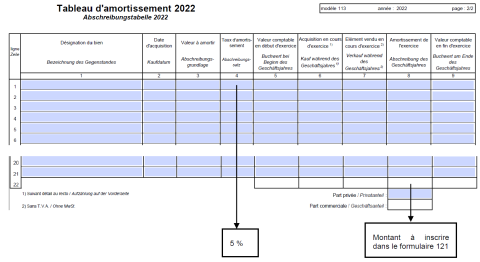

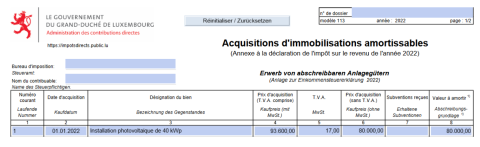

3.3. Acquisitions of depreciable capital assets (Form 113)

This annex is used to determine the depreciation to be deducted from the commercial benmercial. commercial.

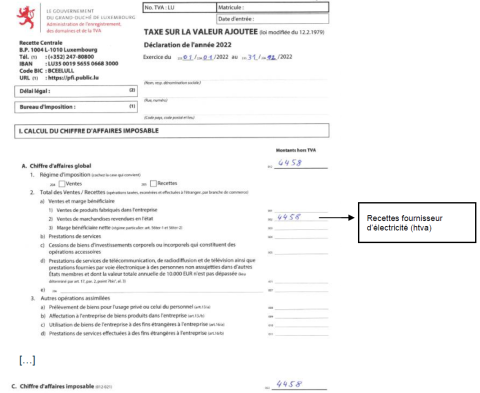

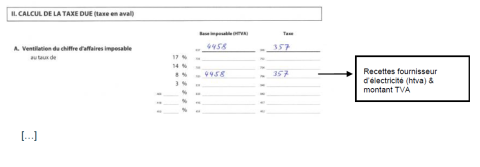

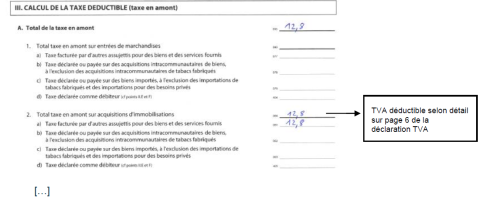

4. Value Added Tax – VAT

Any individual who operates a photovoltaic system is considered to be liable for VAT. However, if the annual turnover is less than €50,000, the private individual is subject to the provisions of Article 57 of the VAT Act and benefits from the "régime particulier des petites entreprise” (special scheme for small businesses). In this case, they are exempt from making a VAT return, but must report their turnover for the previous year2 to the Registration Duties Authority by 1 March each year.

Anyone subject to the small business scheme is also free to opt for the standard VAT scheme. In this case, they get the right to reclaim input VAT and a regular VAT number.

VAT registration entails the obligation to submit an annual VAT declaration (via MyGuichet or via forms to be downloaded from the AED website). In this case, the VAT on the investment (a priori 17 % in the case of a supplier from the Grand Duchy of Luxembourg) is deductible and the amount is taken into consideration when calculating the depreciation is the amount excluding VAT of the investment (reduced by the subsidies obtained). As for revenue, the VAT collected on the sale of electricity (8%) must be declared annually using the form that can be downloaded from the Administration de l'Enregistrement et des Domaines (http://www.aed.public.lu/formulaires/index.html).

More detailed information can be found in “article 1, paragraphe 2 du Règlement grand-ducal modifié du 21 janvier 1980” (article 1, paragraph 2 of the amended Grand-Ducal Regulation of 21 January 1980 laying down the conditions and procedures for the application of the tax exemption scheme provided for in respect of value added tax:

«L’assujetti soumis au régime de franchise de taxe prévu à l’article 57, paragraphe 1er, de la loi TVA est déchargé de l’obligation de dépôt de déclarations prévue à l’article 64, paragraphe 1er, de la loi TVA, à condition de ne pas avoir effectué, au cours de l’année civile, des prestations de services pour lesquelles le preneur du service non établi à l’intérieur du pays est le redevable de la taxe, et de n’être redevable, en vertu des dispositions de l’article 61, d’aucune taxe devenue exigible au cours de cette année civile.

L’assujetti visé à l’alinéa 1 doit cependant, avant le premier mars de l’année civile, informer l’Administration de l’enregistrement et des domaines, désignée ci-après par « l’administration », par écrit du montant de son chiffre d’affaires réalisé au cours de l’année civile précédente.

[1] Article 1, paragraphe 2, du Règlement grand-ducal modifié du 21 janvier 1980 ayant pour objet de fixer les conditions et modalités d'application du régime de franchise prévu en matière de taxe sur la valeur ajoutée (Article 1, paragraph 2, of the amended Grand-Ducal Regulation of 21 January 1980 laying down the conditions and procedures for the application of the exemption system provided for in respect of value added tax)

4.1 3% VAT

Since the 1st January 2023, the reduced rate of 3%3 has been applied to the supply and installation of solar panels, provided that the panels are installed on or in the immediate vicinity of private housing or public and other buildings serving the public interest. This reduced rate of 3% should not be confused with the 3% housing VAT.

All the components needed to install and operate the solar panels are covered by the reduced rate, including the following: photovoltaic panels (or hybrid solar collectors), mounting rails, DC and AC electrical wiring directly linked to the photovoltaic system, inverter, electrical protection devices, two-way meter; and for solar thermal panels: thermal solar collectors, mounting rails, DC and AC electrical wiring directly linked to the photovoltaic system, inverter, electrical protection devices, two-way meter; and for solar thermal panels: solar thermal collectors, mounting rails, DC and AC electrical wiring directly linked to the photovoltaic system, inverter, electrical protection devices, two-way meter; and for solar thermal panels: solar thermal collectors, mounting rails, DC and AC electrical wiring directly linked to the photovoltaic system: solar thermal collectors, mounting rails, insulated piping, solar storage tank, calorimeter, peripheral installations (power supply, regulation, heat exchangers); and of course the installation costs.

For photovoltaic solar panels, a storage installation (battery) is therefore not concerned.

In practical terms, this means :

- in the case of a completed supply/service, the applicable VAT rate is that in force on the day the supply/service is carried out (completed) (operative event)

- in the case of payments on account, the applicable VAT rate is that in effect on the day of collection of the payment on account.

5. Example of tax treatment for a 40 kWp installation

5.1. Assumptions

| Acquisition cost of a 40 kWp photovoltaic system on 01/01/2023 : | ||

| 80.000 € hVAT | 13.600 € (17 %) | |

| 93.600 € incl. VAT | ||

| Taxable person subject to VAT | ||

| Depreciation (5 %) : 4.000 € per year (5 % of 80.000 €) | ||

| Annual electricity production | 37.334 kWh/y | |

| Total feed-in with guaranteed feed-in tariff of €0.1194/kWh | Self-consumption with a negotiated tariff of 0,099[1] €/kWh | |

| Annual revenue | 4.458 € | 2.513[2] € |

[1]https://assets.ilr.lu/energie/Documents/ILRLU-1685561960-1173.pdf, 80 % de la moyenne de la période janvier-novembre 2023

[2] Taux d’autoconsommation de 15 %, donc injection de 31.734 kWh

5.2. Form 113 (depreciation)

5.3. Form 121 (Photovoltaic system)

5.4. Annual VAT return